The Hon Nicola Willis, Minister of Finance, has recently unveiled proposed amendments to tax legislation aimed at rectifying the over-taxation of low-earning trusts. These changes, recommended by Parliament’s Finance and Expenditure Committee after thorough consideration of submissions on the Taxation (Annual Rates for 2023–24, Multinational Tax, and Remedial Matters) Bill, seek to promote fairness and clarity in the tax system.

One of the key objectives of the Bill is to establish equity in tax rates for high-income individuals, regardless of whether they receive income directly or through a trust. Initially, the Bill posed a concern as it would have subjected many lower-income trusts to the top tax rate of 39 cents in the dollar. However, following submissions, the Committee proposed a more balanced approach.

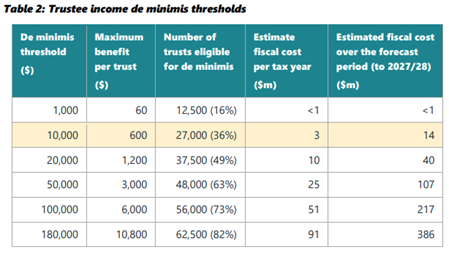

Here is a breakdown of the thresholds considered:

Source: https://www.ird.govt.nz/

Please note that, aside from the $10,000 threshold, the estimates provided are not formal costings and are meant to offer a general idea of the fiscal impact of various thresholds. If a threshold exceeding $10,000 is implemented, specific regulations may be required to mitigate the risk of taxpayers utilising multiple trusts to benefit from a lower tax rate. The estimates provided are cautious and do not consider any behavioural changes or additional integrity measures.

Under the revised recommendations, trusts with trustee income up to $10,000 (after deductible expenses) will continue to be taxed at a rate of 33%, while trusts with income exceeding this threshold will be taxed at 39%. These adjustments aim to ensure that taxation aligns with income levels, fostering a fairer tax regime.

Moreover, the Committee has put forth measures to simplify compliance for estates and trusts settled for disabled individuals, advocating for a fixed trustee rate of 33% for disabled beneficiary trusts and deceased estates. Additionally, energy consumer trusts and legacy superannuation funds are set to be excluded from the 39% trustee tax rate, further streamlining the tax framework.

The Taxation (Annual Rates for 2023–24, Multinational Tax, and Remedial Matters) Bill is scheduled for its second reading in the House on 19 March 2024. These proposed changes signify a step towards a more equitable and efficient tax system, ensuring that trusts are taxed fairly and compliance is made more straightforward for all stakeholders.

At Moore Markhams, we have subject matter experts who take the guess work out of accounting. Want to take your accounting to the next level? Get in touch with us today by clicking

here.