On Tuesday 28 September, the Government released the draft legislation outlining the details of the policy limiting the deductibility of interest costs for residential property investments.

It should be remembered that these are still not the final rules but do give a good indication of what we could expect. The rationale behind the legislation is to stem investor demand for existing residential properties, instead encouraging investors to build new housing stock, leaving existing for first time home buyers.

As the current legislation is still in draft stage, we strongly advise contacting your Moore Markhams advisor before relying on this commentary.

What Defines a ‘New Build’

-

Defined as a self-contained residence that receives Code of Compliance Certificate (‘CCC’) confirming the residence was added to the land on or after 27 March 2020.

-

It will also include a self-contained residence acquired off the plans that will receive its CCC on or after 27 March 2020 confirming it has been added to the land.

-

The new build will not have to be made of new material or constructed onsite, so it can include modular or relocated homes.

-

Converting an existing dwelling into multiple new dwellings will also qualify as a new build.

-

The conversion of a commercial building into residential dwellings will also be deemed a new build.

-

The exemption applies from either:

-

The date you acquire your new build – if it already has a CCC or is acquired “off the plans”, OR

-

The date your new build receives CCC.

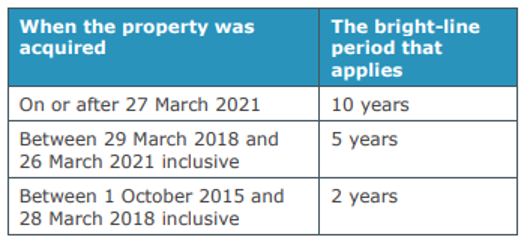

A residential rental property that is deemed a new build will have a five year bright-line test and any interest relating to the purchase will be deductible to the taxpayer.

Expiry of exemption for New Builds

The exemption will expire 20 years after a new build receives its CCC or when the new build ceases to be on the land (for example, it is demolished or removed), whichever is earlier.

The exemption will apply to anyone who owns the new build within this 20-year fixed period, and the timing of the exemption will not reset when the property is sold.

Interest Limitation Rules

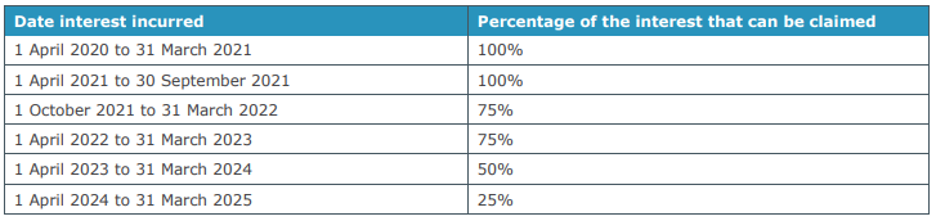

How interest deductibility will be phased out for properties acquired before 27 March 2021

The above table confirms what was previously released regarding the phasing out of interest for properties acquired before 27 March 2021. It should be noted that there is an 18-month period from 1 October 2021 to 31 March 2023 where only 25 percent of the interest will be deemed non-deductible.

From a landlord’s perspective this provides a reasonable time where the increased tax is not too cumbersome and allows a less rushed approach to selling existing residential investment properties if that is the landlord’s intention.

In short, landlords need not rush to sell these properties if the increased tax cost is the sole motivator.

Properties that will be excluded from the Interest Limitation Rules

-

A full list of exclusions can be found here, but of key interest:

-

Properties used as business premises (except for an accommodation business), like offices and shops. This includes residential properties to the extent they are used as business premises (for example, a house converted into a doctor’s surgery)

-

Farmland

-

Commercial accommodation such as hotels, motels, and hostels (but not short-stay accommodation provided in a residential dwelling)

Exemptions to the Interest Limitation Rules

If you hold land as part of a developing, subdividing, or land-dealing business, or a business of erecting buildings on land then the land business exemption will apply, and interest will be deductible as usual.

If you do not qualify for the land business exemption then the development exemption will apply relating to land that you develop, subdivide, or build on to create a new build. The exemption applies from the time you start developing the land and will end when you either sell the land or receive CCC for your new build. Once your new build receives its CCC the new build exemption will apply instead.

Notable points regarding current loans and structures

-

Refinancing properties acquired prior to 27 March 2021 will allow phased out deductibility up to the level of the original loan

-

Variable loans, such as a revolving credit or overdraft will be phased out and capped at debt levels as of 27 March 2021

-

Borrowing for other purposes will not be affected as the tracing rules apply and security against a residential property does not affect the purpose of the loan

-

Property rented out and also used privately, as is the case for holiday homes, will be affected by these rules

-

Changes in how property is held may not deny an interest deduction if certain rollover relief applies

-

Mixed use loans will need to be analysed and traced to determine deductible and non-deductible portions

Disallowed Interest not lost forever if sale of property taxable

If you sell a property where interest has been disallowed under these rules AND the gain on the sale is taxable under the bright-line rules, then the previously disallowed interest will be able to be added to the cost base of the property.

For example:

-

John buys an existing residential rental property in October 2021;

-

The interest limitation rules apply and no interest deductions are allowed;

-

John then sells the property within the relevant bright-line period for a taxable gain of $45,000;

-

The total non-deductible interest from when John owned the investment property was $15,000;

-

Therefore, John will only pay tax on the $30,000, being the taxable gain less the previously disallowed interest.

Note – that if the disallowed total interest exceeds the taxable gain, then any excess is carried forward and able to be off-set against any other land sale gains of the taxpayer.

Changes to the Bright-Line Property Rules

Changes to the Main Home Exclusion

Predominant land use

The current rules ensure that if more than half the land is used as a main home then the bright-line property rules don’t apply.

However, this exclusion doesn’t apply if you use less than half the land for a main home. Currently if more than half the land is used as a residential rental property then the total gain on sale is taxable.

The proposed change is to allow apportionment of the gain where the main home is less than half the land. Therefore, if 60 percent of the land relates to rental land and 40 percent to the main home only 60 percent of the gain is taxable. Under the current rule this would be 100 percent taxable.

Change-of-use rule

For any property purchased on or after 27 March 2021, that is a main home but is not used as your main home for any continuous period or periods of more than 12 months during the bright-line period, the main home exemption will not apply to the period(s). You will pay tax on the portion of profit that relates to the period(s). This is the ‘change-of-use’ rule.

Rollover relief for certain changes of ownership

Rollover relief allows the original owner to transfer property to the new owner without triggering a deemed bright-line sale. The new owner will be treated as having acquired the land when it was acquired by the original owner. The Government has proposed that in limited circumstances some transfers of ownership may receive rollover relief.

If you have any queries, please contact your Moore Markhams advisor.

Prepared by Moore Markhams director, Toby Laidlaw, who has specialist property tax and land tax expertise.